Cash App vs Venmo: Demographics, Fees & Which to Accept (2025)

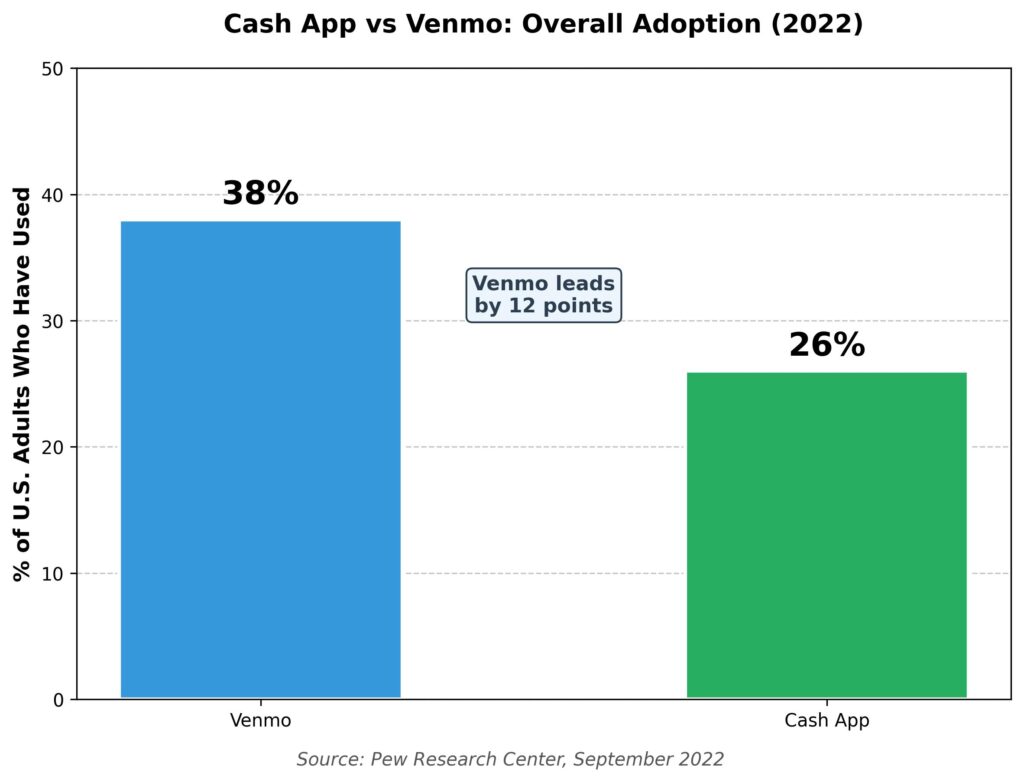

Cash App and Venmo dominate the peer-to-peer payment landscape, yet they serve distinctly different audiences. According to Pew Research, 38% of U.S. adults have used Venmo compared to 26% who have used Cash App [1]. For merchants deciding which platforms to accept, understanding these differences is essential for matching payment options to customer demographics.

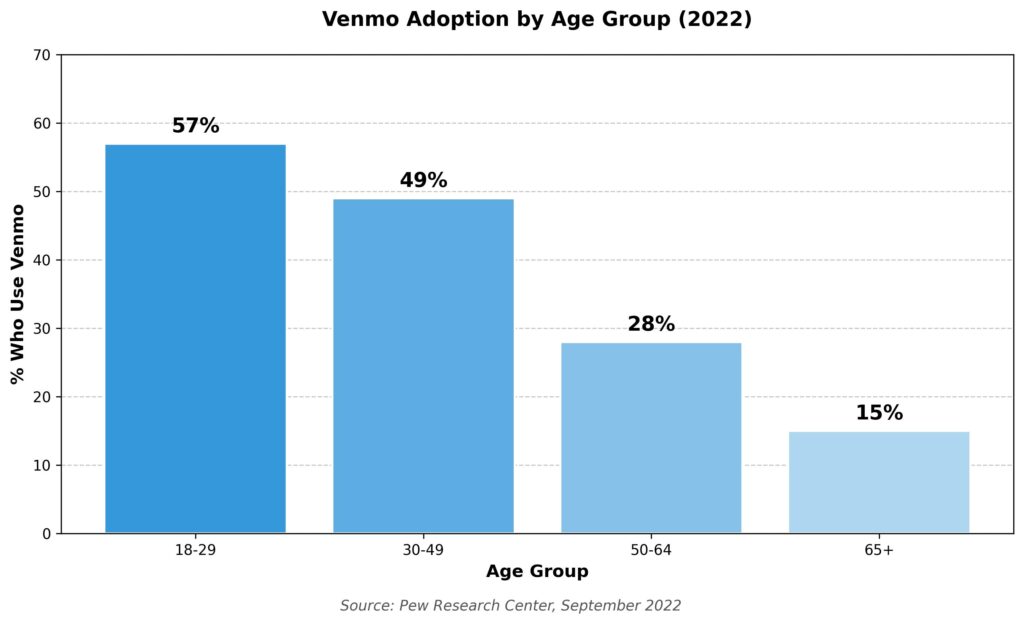

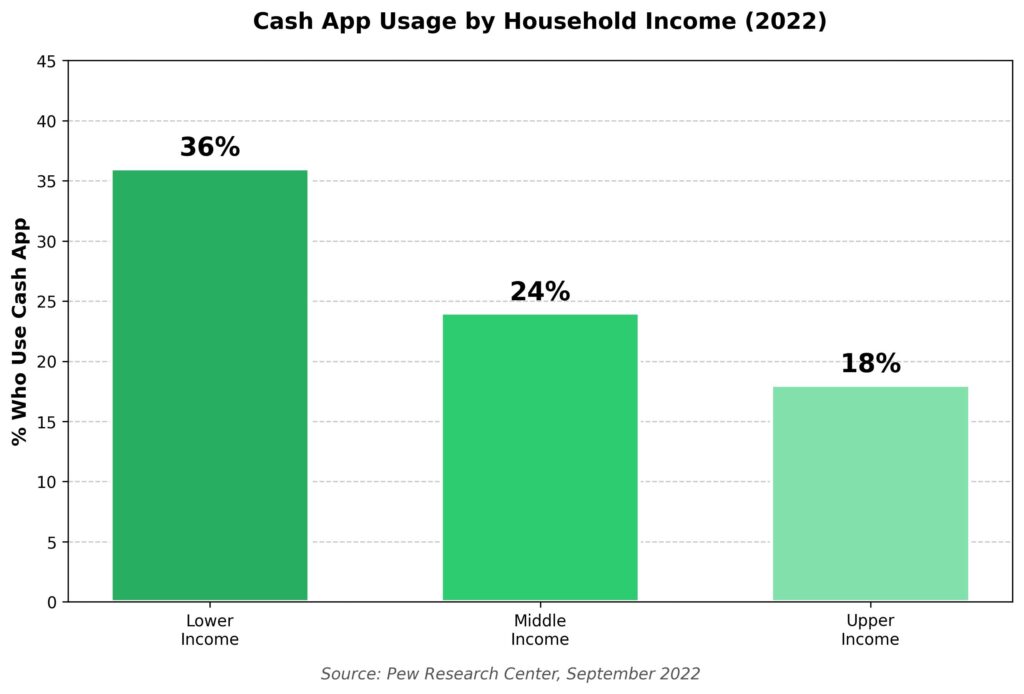

The divide between these platforms runs deeper than market share. Venmo skews younger and more affluent, with 57% of adults aged 18-29 using the platform [1]. Cash App, by contrast, shows strongest adoption among lower-income Americans (36%) and Black Americans (59%) [1]. These patterns have direct implications for which platform makes sense for your business.

This comparison breaks down the key differences between Cash App and Venmo across adoption demographics, fees, features, and merchant considerations – using verified data from Pew Research Center and federal sources.

Overall Market Position

Venmo holds a clear lead in overall adoption. Pew Research found that 38% of U.S. adults have used Venmo, compared to 26% for Cash App [1]. Both trail PayPal (57%) but exceed Zelle (36%) in overall familiarity.

This 12-point gap reflects Venmo’s earlier market entry and its success capturing the college-age demographic. However, Cash App has carved out distinct niches where it leads, particularly among lower-income communities and Black Americans [1].

Age Demographics: Venmo Dominates Youth

The age gap in Venmo adoption is striking. According to Pew Research, 57% of adults aged 18-29 use Venmo, compared to 49% of those 30-49, 28% of those 50-64, and just 15% of those 65 and older [1]. This represents the starkest age gap among all major P2P platforms.

For merchants targeting younger demographics – restaurants near college campuses, bars, entertainment venues – Venmo acceptance is effectively mandatory. The platform’s social feed feature, which displays transactions to friends, has made it particularly popular for splitting bills and group payments among younger users [1].

Income Demographics: Cash App Serves Lower-Income Users

Cash App shows the opposite pattern from Venmo when it comes to income. Pew Research found that 36% of lower-income adults use Cash App, compared to 24% of middle-income and 18% of upper-income adults [1]. This makes Cash App unique among major P2P platforms.

Venmo shows the reverse pattern: adults with upper incomes are more likely than middle- and lower-income adults to use the platform [1]. For merchants, this income divide matters. Businesses serving budget-conscious customers should prioritize Cash App acceptance; those serving affluent demographics may find Venmo more relevant.

Racial Demographics: Cash App Leads Among Black Americans

Cash App shows distinct adoption patterns across racial groups. According to Pew Research, 59% of Black Americans report using Cash App, compared to 37% of Hispanic Americans, 17% of White Americans, and 16% of Asian Americans [1].

This demographic pattern has significant implications for merchants. Businesses in predominantly Black communities or those specifically serving Black customers should consider Cash App acceptance a priority. The platform’s strong brand recognition in these communities means customers may expect or prefer Cash App as a payment option.

| Demographic | Venmo Strength | Cash App Strength |

| Age | Young adults (18-29): 57% | Broadly distributed |

| Income | Upper-income adults | Lower-income adults: 36% |

| Race | Broadly distributed | Black Americans: 59% |

| Overall | 38% of U.S. adults | 26% of U.S. adults |

Source: Pew Research Center, September 2022 [1]

Fee Structure Comparison

Both platforms offer free standard transfers to bank accounts, which typically take 1-3 business days. The key fee differences emerge with instant transfers and business transactions.

| Fee Type | Venmo | Cash App |

| Standard bank transfer | Free (1-3 days) | Free (1-3 days) |

| Instant transfer | 1.75% (min $0.25, max $25) | 0.5%-1.75% |

| Credit card payment | 3% | 3% |

| Business transactions | 1.9% + $0.10 | 2.75% |

| ATM withdrawal | Free at MoneyPass; $2.50 otherwise | $2.50 (free with $300+ direct deposit) |

Note: Fees are current as of 2024 and subject to change. Verify on official platform websites.

Business Features

Both platforms offer business accounts, but with different fee structures. Venmo charges 1.9% plus $0.10 per transaction for business payments received from other Venmo users. Cash App for Business charges a flat 2.75% fee on transactions.

For merchants processing high volumes of small transactions, Venmo’s per-transaction fee structure may be less favorable. For those processing fewer, larger transactions, Cash App’s percentage-only model may cost more. The right choice depends on your average transaction size and volume.

Security and Insurance Considerations

The Consumer Financial Protection Bureau has warned that funds stored in payment apps like Venmo and Cash App may not have federal deposit insurance protection [2]. Unlike traditional bank accounts, balances held within these apps are not automatically FDIC-insured.

Both platforms offer security features including PIN protection, biometric authentication, and the ability to disable access remotely. However, neither provides the same regulatory protections as a traditional bank account. The CFPB advises consumers to transfer funds to insured bank accounts rather than storing them long-term in payment apps [2].

Trust and Adoption Barriers

Distrust remains a significant barrier for non-users of both platforms. According to Pew Research, 58% of Americans who have never used P2P payment apps cite distrust as a major reason [1]. This skepticism is particularly pronounced among older Americans: 67% of those 50 and older who have not used these apps say distrust is a major factor [1].

For merchants, this means that offering P2P payment options works best as a supplement to, not replacement for, traditional payment methods. Customers who distrust these platforms will still need card or cash options.

Which Platform Should Merchants Accept?

The choice between Cash App and Venmo – or whether to accept both – depends on your customer demographics:

Accept Venmo if: Your customers skew younger (under 40), have higher incomes, or you operate in settings where bill-splitting is common (restaurants, entertainment venues, group activities).

Accept Cash App if: Your customers include significant lower-income populations, your business serves predominantly Black communities, or you need a simple flat-fee structure for business transactions.

Accept both if: Your customer base is demographically diverse, or you want to maximize payment flexibility. The marginal cost of accepting an additional P2P platform is minimal compared to the potential sales lost by not offering a customer’s preferred payment method.

Conclusion

Cash App and Venmo serve overlapping but distinct markets. Venmo leads in overall adoption (38% vs 26%) and dominates among younger, higher-income users [1]. Cash App has carved strong positions among lower-income Americans and Black Americans, where adoption rates reach 36% and 59% respectively [1]. Cash App stands out with a more generous and unlimited referral program ($15 for new users) compared to Venmo ($5 for new users).

For merchants, the data from Pew Research points to a clear strategy: match your P2P acceptance to your customer demographics. Neither platform is universally superior – the right choice depends entirely on who you serve.

References

- Pew Research Center – Payment apps like Venmo and Cash App bring convenience and security concerns to some users (September 2022)

- Consumer Financial Protection Bureau – Analysis of Deposit Insurance Coverage on Funds Stored Through Payment Apps (2023)

- Federal Reserve Bank of Atlanta – 2023 Survey and Diary of Consumer Payment Choice